My new portfolio and thesis.

I basically spent a full 5 days and probably 40-50 hours contemplating over things, figuring out my diminishing risk tolerance with increasing portfolio size, and figuring out what I think is the safest way to potentially beat the total world stock market, while minimizing risk.

The strategy is a combination of equity positions + options

Goals:

1) Minimize Volatility.

2) Get returns slightly better than VT (total world stock market).

3) Make portfolio such that I can look at the market for 10 minutes daily and don't have to react on bad days. Essentially minimize my time on etrade trading. And hopefully over time get to a point where I dont look at the market for several days.

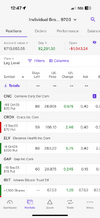

Equity Portfolio: 100% of the cash in the account is in the following. The idea is to get market returns from this part of the portfolio.

40% - SPY

40% - VXUS

10% - IBIT (previously was at 12% but decided my risk appetite is more around 10%)

10% - SPYI

Margin maintenance Excess - I have a portfolio margin account. Even when 100% of cash is used up, my account still has significant margin maintenance excess where I can open options positions at NO interest. So essentially, I get charged interest if my equity position is higher than the cash in my account (it's not), and I get capital calls if my maintenance excess becomes negative - so two completely different things.

The above positions use the following maintenance excess:

SPY - 30% (so 100k of SPY purchased, leaves 70k of maintenance excess)

VXUS - 30%

IBIT - 100%

SPYI - 30%

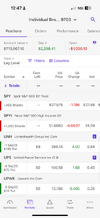

Options portfolio: My account is worth 712k currently (moved 50K to public.com for play money) - Opening equity positions of 712k in the above equities leaves about 445k of margin maintenance excess - I can use this maintenance excess for selling naked puts and adding to yield.

Covered calls on IBIT - Far OTM with goal to get 6-7% annualized yield from my bitcoin holding, so protecting downside, while mostly still participating in the upside. For example IBIT was purchased for $67.5 (1100 shares at $74K). I sold 11 covered calls for $85 strike, 60 DTE, and received $781 in premium (1.05% return in 60 days on my bitcoin holding). If bitcoin goes >25% up in 2 months, my position will lose money, but my bitcoin holding will then gain massively. I plan to roll up and out if IBIT goes >80 in 2 months. The covered call will help the downside bitcoin risk which would be nice to have with bitcoins volatility.

Naked Puts sold on RUT - EXTREMELY FAR OTM. $1650 strike. 60 DTE. Relatively small position size. 99% probability of winning based on todays volatility. Received 2k premium (0.28% return in 2 months in a 712k account, 1.68% annualized). Will close at 50% profit and open another 60 DTE position. Or if the market goes EXTREMELY negative, then will close at 100% loss (2k loss) and open another 60 DTE position. The win percentage of 99% should mathematically mean the expected return should be around 1.5% or so annualized even with the occasional losses once every 2-3 years when a large 20% drop happens in a short time. Other benefits include:

- Synthetic small cap tilt through options. I think large cap is slightly over valued and small cap might do better over the long term. These RUT positions increase my small cap exposure while SPY has no small cap exposure.

- Tax 1256 treatment. All capital gains will be 60% long term and 40% short term.

- Should win these trades almost every time for a slight increased return.

Naked puts sold on XSP - Same as above, extremely out of the money, but on SP500 instead of Russell 2000. Same theory. Current holdings is 5 contracts of XSP - $400 received. $500 strike, 60 DTE, So an extra 0.33% annualized return with 99% probability of winning.

SPYI - This itself is a covered call ETF yielding 12% with monthly returns as "dividends". Tax advantaged. 1256 tax treatment. Will out perform SPY in a flat or slightly down market. Will underperform SPY with V shaped recoveries, but will participate in upside if slower recovery after a drop. This is a lower risk holding than SPY itself.

Naked puts on High conviction single stocks - Very very small holdings, short 45-90 DTE, extremely out of the money, profitable value companies trading at reasonable P/E ratios, fairly small positions that are extremely out of the money. Current holdings - CNC, ELV, GAP, LULU, UPWK, UPS, UNH, CROX. ~ $5k extra premium in 3 months on EXTREMELY out of the money positions with 95-99% likelihood of winning. Positions are small enough with a low enough strike, not being greedy essentially, and just getting a tiny extra return. An extra 3-4% annualized return is the goal. Plus this adds a small value tilt through options.

So all in all - The goal of the options positions are to get an extra 4-5% annualized return on top of the equity positions. During sudden market drops of 20% or so in 1-2 months, my portfolio will under perform SPY slightly due to the naked put positions. This should be temporary. But a disciplined approach of sticking with 60 DTE positions and closing at 50% profit or 100% loss will result in over time positive returns due to theta decay especially as over time markets continue to go up. Inherently as a put seller, and theta decay, this should result in a added positive return.

Position sizes are SMALL. Only aiming for 8.5k premium currently in 3 months (4.77% annualized). Maintenance excess is still 228k - This excess allows for EXTREME MARKET DROPS like 30-40%, and essentially not get margin calls.

Benefits of portfolio:

- Out performance if we get a flat decade (due to SPYI and options premium)

- Out performance if bitcoin continues its bull run

- Out performance if a slow decline of a recession - Like 20% drop over 9 months. (SPYI and my options will outperform).

- Otherwise portfolio will mimic VT with a bitcoin tilt.

- world wide diversification - mitigated concentration risk in US equities given high valuations currently

Risks of portfolio:

- Bitcoin under performance, who knows what it will do. Though mitigated by covered calls.

- V shaped recoveries (SPYI underperformance). Mitigated by naked puts that will give extra upside on the way up.

- Large drops in single stock options (but position size is small enough to not effect the larger portfolio as much).

- international under performance compared to spy.

All in all - I think my portfolio now has an extremely high chance of beating VT over very long periods of time and it will do so at minimal increased risk. Nothing is absolute, but mathematically, there's a 95-99% probability of out performance.