- Joined

- Apr 7, 2021

- Messages

- 348

- Reaction score

- 217

Because we are exponentially in more debt collectively since 07/08. Nothing was fixed, just delayed. If you keep giving a homeless unemployed drug addict 5 million dollar loans everytime he hits crisis levels, if he doesn't change his ways do you really think his balance sheet isn't getting worse despite having constant new cars, condo, fancy clothes, eating at great restaurants, and appearing great?What makes you think we are “heading for a 07/08 situation”? Have banks had really lax lending standards leading to billions of worthless subprime mortgages for the banks?

How to invest? Oil. Defense stocks. Gold. Trading technicals.

You are off by decades in your thesis. You will ultimately be correct but I'll be long dead and you will be broke most of your life if you invest with this thesis. The USA is on SOLID Ground for many ,many years to come because we have the reserve currency, the biggest/most expensive military and a huge tax base which to suck money from as needed. As much as I hate to say, the drunken sailors in Washington can keep spending money for years to come. My grandkids will pay the price for this mess but you all can make a small fortune until that day of reckoning happens.Because we are exponentially in more debt collectively since 07/08. Nothing was fixed, just delayed. If you keep giving a homeless unemployed drug addict 5 million dollar loans everytime he hits crisis levels, if he doesn't change his ways do you really think his balance sheet isn't getting worse despite having constant new cars, condo, fancy clothes, eating at great restaurants, and appearing great?

Everyone is capable of understanding this on that simplistic level, and on a larger Madoff ponzi level, but so many go into blind denial when it's the government doing the endless borrowing and printing to float this bloated house of cards on life support.

If we're in such a solid financial position why would balancing the budget put us in catastrophic short term crisis? Have you ever seen the fear that races through America when there is a delay in raising the debt ceiling? What does that tell you? That's we're in a "great position" financially as long as we can live off of exponentially increasing debt. If that ain't an oxymoron I don't know what is.

Very much agree that the Fed will choose runaway inflation over a crashing economy and stock market, and a surprise rate drop will eventually happen causing a buying frenzy.Idiots who never lived through multiple bear markets especially 2008. In 2008, there was fear, contagion to the point we thought stocks could go to ZERO. That last drop off was the FEAR reaching levels like late 1920's. It isn't relevant to 2022/2023. We won't see that 1,000 point drop on the S and P 500 because the FED would just "pivot" before we crash. The FED had lost control in 2008 and only US govt. intervention saved stocks. The FED is in complete control today and can literally cause a 400 point rally by just cutting rates 0.25% tomorrow.

I just been buying on the way down and hopefully when it goes up again. Don’t know when or why or even how at this point.You all can believe in the naysayers or listen to the greatest investor of all time: Warren Buffett. Once this bear market shows its teeth again at let's say 10% lower from here, you should be buying stocks with good valuations, great long term prospects and products you believe in. Or, just buy the S and P 500 or VTI and enjoy the ride up from the bottom.

There's truth in that, and I never claim to say when the day of reckoning is. So while I agree the day to day footing is stronger than than 08, the underlying foundation is significantly worse.You are off by decades in your thesis. You will ultimately be correct but I'll be long dead and you will be broke most of your life if you invest with this thesis. The USA is on SOLID Ground for many ,many years to come because we have the reserve currency, the biggest/most expensive military and a huge tax base which to suck money from as needed. As much as I hate to say, the drunken sailors in Washington can keep spending money for years to come. My grandkids will pay the price for this mess but you all can make a small fortune until that day of reckoning happens.

This is like blaming the police for causing crime because they lost control of it, and ignoring the many true causes of crime whatever they happen to be (not looking for a crime debate).The FED had lost control of the economy in 2007/2008 because it didn't act fast enough and with decisive action to stimulate growth.

August 2007. The Stock market has not crashed yet but was on its way down towards zero.

Here’s the portfolio that the apocalypse predictors should invest in:

90 % stocks

10 % guns/ bunkers / survival food

Seriously. You’ll win either way then. I’m actually only partially kidding as my portfolio isn’t that far off from that.

Throw gold in there and I'm right there with you 🤣Here’s the portfolio that the apocalypse predictors should invest in:

90 % stocks

10 % guns/ bunkers / survival food

Seriously. You’ll win either way then. I’m actually only partially kidding as my portfolio isn’t that far off from that.

The USA is on SOLID Ground for many ,many years to come because we have the reserve currency, the biggest/most expensive military and a huge tax base which to suck money from as needed. As much as I hate to say, the drunken sailors in Washington can keep spending money for years to come. My grandkids will pay the price for this mess but you all can make a small fortune until that day of reckoning happens.

Are you going to selectively quote this bumbling idiot as the great soothsayer? 😂

"So subprime blows up, So What?" says Cramer.

Tesla EPS for the twelve months ending September 30, 2022 was $3.24,At what price would you buy Tesla stock? The forward P/E is now 20. I would be a buyer at $100 or less as Tesla is a great company with a lot of growth ahead the next few years. I never liked Tesla stock because the P/E was always absurd. But, a forward P/E of 15 and I just have to buy in to Musk/Tesla. In 3 years, Tesla will be selling a lot more automobiles and the P/E can still be 15 yet I make money. I see Tesla stock doubling in 3 years to $200 and that is still way, way off the recent highs.

"We continue to forecast that Tesla will deliver nearly 1.4 million and 2.1 million vehicles in 2022 and 2023, respectively."

Maintaining $250 Fair Value for Tesla

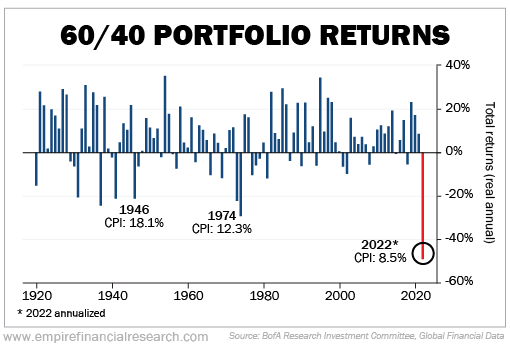

I don't really dabble in bonds, probably should, but shouldn't they keep going down in value for a while with the series of rate hikes still coming?The S&P 500 has fallen by an average of 28% in recessions since World War Two, data from CFRA showed, though some argue this year's tumble - which hit 25.2% in October - suggests equities have at least partially factored in a slowdown. The S&P 500 is down about 20% on a year-to-date basis.

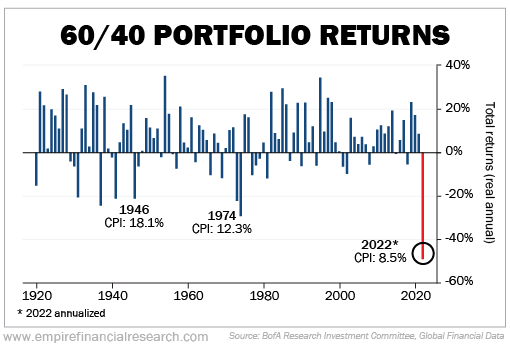

Still, Jason Pride, chief investment officer of private wealth at Glenmede, believes deep declines have increased the strategy's attractiveness over the long term.

"For the next 10 years 60/40 portfolios are at a lot better starting place than they have been in years, and that's in large part because bonds are in a very favorable position," he said.

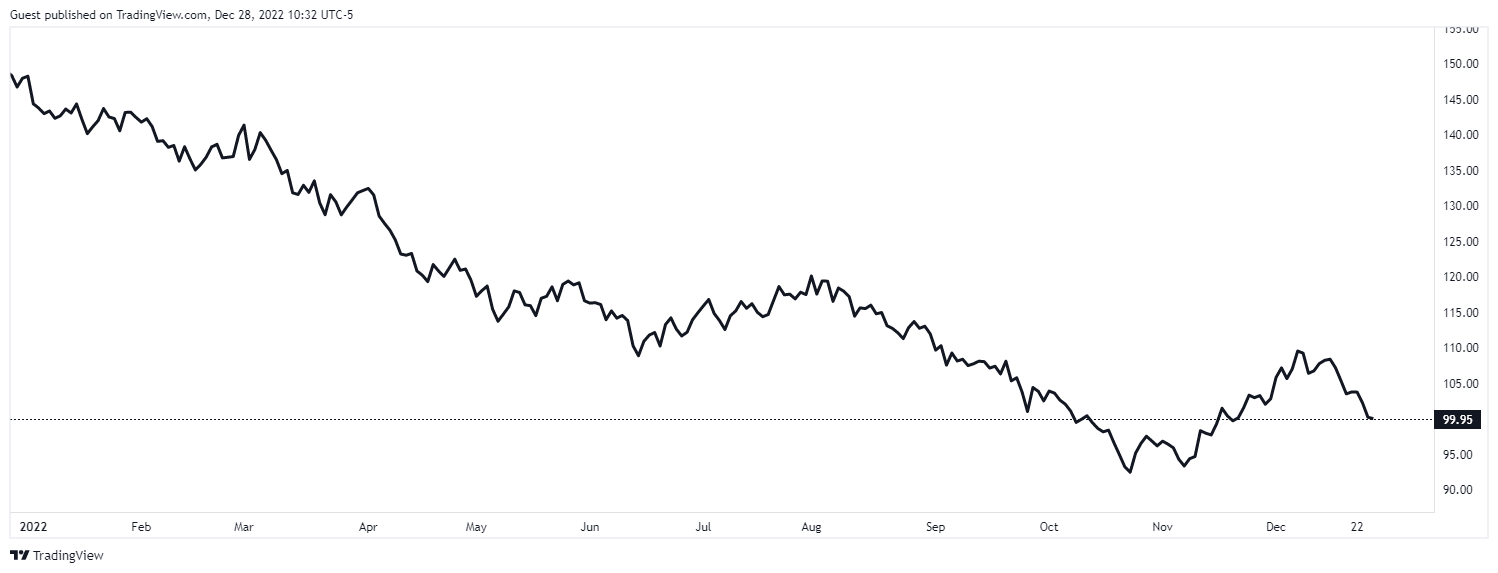

If we take a look at the TLT chart, we can see a recent double bottom in early Nov. This rally was totally expected and now we are seeing the pullback. We will come back down and retest this bottom. Then it's off to the races in the bond market. Load up on TLT calls and TBT puts on a downswing near that bottom? This will be the time to get into bonds. The more I read about this, the more I think we will see bonds dominate in the coming decade and the decline of the 100% S&P passive invest strategy.

So lets talk about the contrarian play. Everybody and their mother is saying the 60/40 portfolio is DEAD.

Is this the blood in the streets? The time to buy bonds? It sure looks like it. Tell me why I'm wrong and we shouldn't be loading up on bonds now and stocks in 6-12 months when the Fed blows the whole thing up and the S&P tanks 50% to build the perfectly bottom timed long haul 60/40 portfolio with all the cash the smart ones have saved up?

How about a 55/35/10 Stocks/Bonds/Precious metals portfolio? This is the way?!!!

The 1 year treasury is paying almost 5%. This will not last. Probably smart to put some money here. Like Today.

@Moonbeams

also curious what bonds do people buy. straight up treasuries ? etf? corporations? municipals?

you gonna buy 2024 tlt calls? why do you do tbt and tlt at same time?? why not just stick with tlt calls or tbt puts as opposed to both

I buy ETFs to get my premiums. Easy. XYLD vs JEPI vs RYLD vs KNGWhat are good resources to learn more about options? I want to write an option to get passive income on a premium but not sure which companies to look into.

How did you guys wet your feet?

Are those ETFs that sell covered calls on their assets I'm thinking?I buy ETFs to get my premiums. Easy. XYLD vs JEPI vs RYLD vs KNG

What are good resources to learn more about options? I want to write an option to get passive income on a premium but not sure which companies to look into.

How did you guys wet your feet?

Bonds, CDs, HYSA are safest after cash. The rest are all speculative.Protection in 2023:

How can you protect your portfolio if for the sake of discussion we assume the upcoming year or two continue to be ugly? A common risk in all of these ideas is if you are wrong you will limit or completely miss out on gains.

1) Cash. In pure nominal dollars obviously the safest place to be. Biggest risk is inflation which will reduce the actual value of holding cash.

2) Gold. Personally I think it's about the surest future bet at this point. Other than meaningless dips, I just don't see how in our current debt and inflation environment that this can go down and stay down.

3) Go defensive. More boring steady stuff, PG PEP KR MRK etc, less flashy rockets like Nvidia.

4) Shorting. Traditional shorting of a garbage company in a downtown can be very lucrative. It is also incredibly risky if you are wrong in timing or fundamentals because the potential losses are unlimited as opposed to purchasing an asset where the loses are capped at 100%.

You can be completely correct in your financial analysis and literally get wiped out. Carvana presently sits below 5. Imagine all that money you'd make if you shorted it at 100? Well, are we talking April, 2022 on its way to below 5, or May, 2020 on its way to 370? If you took a large greedy position in May, 2020 margins calls would have eventually taken possibly almost your entire portfolio with no chance of riding it out, and this is despite the fact that you were 100% correct in concluding this stock was overpriced garbage. As Barb would say on Shark Tank, And for that reason I'm out.

5) Buying put options. Infinitely safer than shorting a stock because your losses are capped, but you are placing a bad bet that favors the casino as there is a hefty premium in time, strike, and price of options.

6) My preferred method of making money on the demise of the market/sector/stock is a short ETF. You purchase the ETF so losses are therefore capped and you avoid option premiums, although there typically are small fees involved.

7) Selling covered calls on the long positions. This can be a very nice dividend on your holdings that are treading water. Ideally search out larger premiums, shorter expiration dates, and strike prices far enough out that you can live with selling the stock at that price as that is the price your stock appreciation is capped at during the time period your the option is active.

I rarely short a stock and always a very small dollar figure with a hair trigger if I do. I'm only a little more receptive to buying puts, but for the most part I am currently active in methods 1, 2, 3, 6, and 7, but I do also still own very significant long positions in the market.

Please add other advantages/disadvantages I may have missed, as well as other methods of profiting or surviving a downtown.

T-bills paying right under 5%. Will that at lease keep up with inflation?

No riskSounds a little low (inflation is running a little hotter). Also tbills mature in less than one year. You have Reinvestment risk.

rates may be lower upon maturing.. That is the reinvestment risk..No risk

Rate can only adjust upon maturity before repurchasing

You have a very different definition of speculative than the one I'm used to seeing, ie high risk/high reward. What I mentioned are for the most part very conservative ideas; gold, covered calls, defensive stocks, and short etfs as opposed to puts and outright shorting. To be blunt there's nothing speculative about any of that.Bonds, CDs, HYSA are safest after cash. The rest are all speculative.

| Taxable income | Taxes owed |

|---|---|

| $22,000 or less | 10% of the taxable income |

| $22,001 to $89,450 | $2,200 plus 12% of amount over $22,000 |

| $89,451 to $190,750 | $10,294 plus 22% of amount over $89,450 |

| $190,751 to $364,200 | $32,580 plus 24% of amount over $190,750 |

| $364,201 to $462,500 | $74,208 plus 32% of amount over $364,200 |

| $462,501 to $693,750 | $105,664 plus 35% of amount over $462,500 |

| $693,751 or more | $186,601.50 plus 37% of amount over $693,750 |

What I mentioned are for the most part very conservative ideas

They sure nailed it last year! Wall Street strategists see more gains in 2022

The key is the Fed. I expect the Fed will raise interest rates to 5.25% and keep them there for all of 2023. That will make any rally before the final quarter of 2023 highly unlikely. The "street" expects a terminal rate of 5.0% and the Fed to pivot in late 2023. The street will be wrong so 2023 will likely be a flat year.Nobody Knows Nothing.