- Joined

- Oct 10, 2013

- Messages

- 243

- Reaction score

- 140

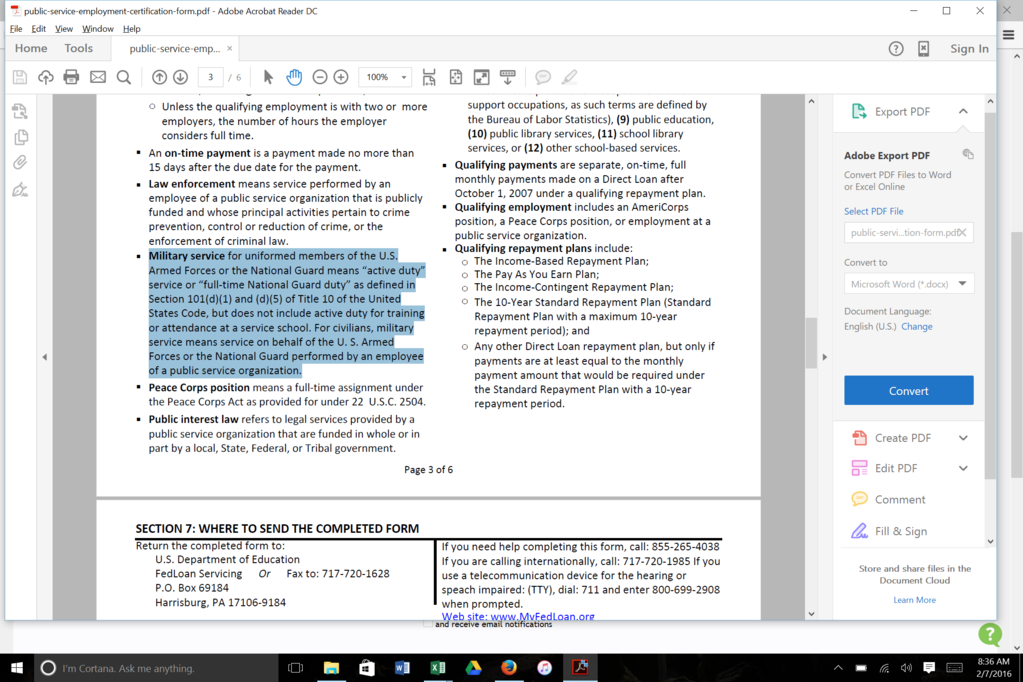

So, I think I've been able to determine that the years spent in dental school don't count for PSLF while on HPSP and even not while on HSCP, despite being "Active Duty." On the attached sheet, which is the Public Service Employment Certification form, under the Military section, it says,

"Military service for uniformed members of the U.S. Armed Forces or the National Guard means “active duty” service or “full-time National Guard duty” as defined in Section 101(d)(1) and (d)(5) of Title 10 of the United States Code, but does not include active duty for training or attendance at a service school. For civilians, military service means service on behalf of the U. S. Armed Forces or the National Guard performed by an employee of a public service organization."

My deduction that years in dental school don't count towards PSLF stem directly from this document. Years in dental school on HPSP are most certainly not counted, since you're in the IRR, but even HSCP years aren't since we're "Active duty for training."

However, are HPSPers and HSCPers considered "Active Duty for training" while at residency? I realize it may be an obvious, "Yes, of course," but I'm thinking that since we get bumped to O3 once done with dental school, perhaps we aren't considered "training" anymore? Can anybody in the know speak to this?

"Military service for uniformed members of the U.S. Armed Forces or the National Guard means “active duty” service or “full-time National Guard duty” as defined in Section 101(d)(1) and (d)(5) of Title 10 of the United States Code, but does not include active duty for training or attendance at a service school. For civilians, military service means service on behalf of the U. S. Armed Forces or the National Guard performed by an employee of a public service organization."

My deduction that years in dental school don't count towards PSLF stem directly from this document. Years in dental school on HPSP are most certainly not counted, since you're in the IRR, but even HSCP years aren't since we're "Active duty for training."

However, are HPSPers and HSCPers considered "Active Duty for training" while at residency? I realize it may be an obvious, "Yes, of course," but I'm thinking that since we get bumped to O3 once done with dental school, perhaps we aren't considered "training" anymore? Can anybody in the know speak to this?