- The stock market's strong gains so far this year are unlikely to see a repeat in 2022, BofA said in a note on Friday.

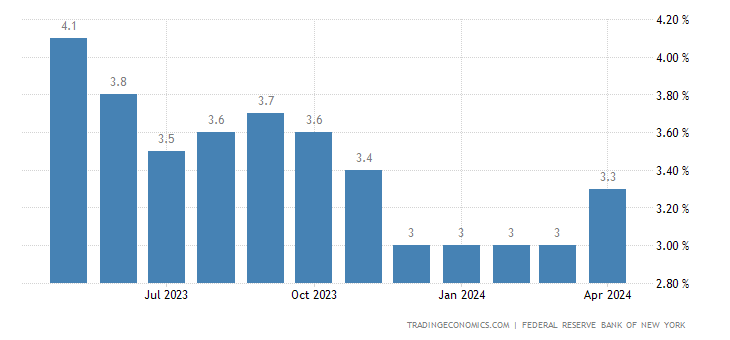

- Rising interest rates represent the third "shock" that will cause a surge in volatility and ding stock prices, according to the note.

- "We are on the cusp of a policy pivot from pro-growth to anti-inflation," BofA said.

2022 is shaping up to be a difficult year for the stock market as the Federal Reserve prepares to make a policy pivot,

Bank of America said in a note on Friday.

Investors shouldn't expect the near 20% year-to-date gains in stocks repeat next year due to a "rates shock" that will occur when the Fed is forced to raise interest rates sooner than expected, according to the note.

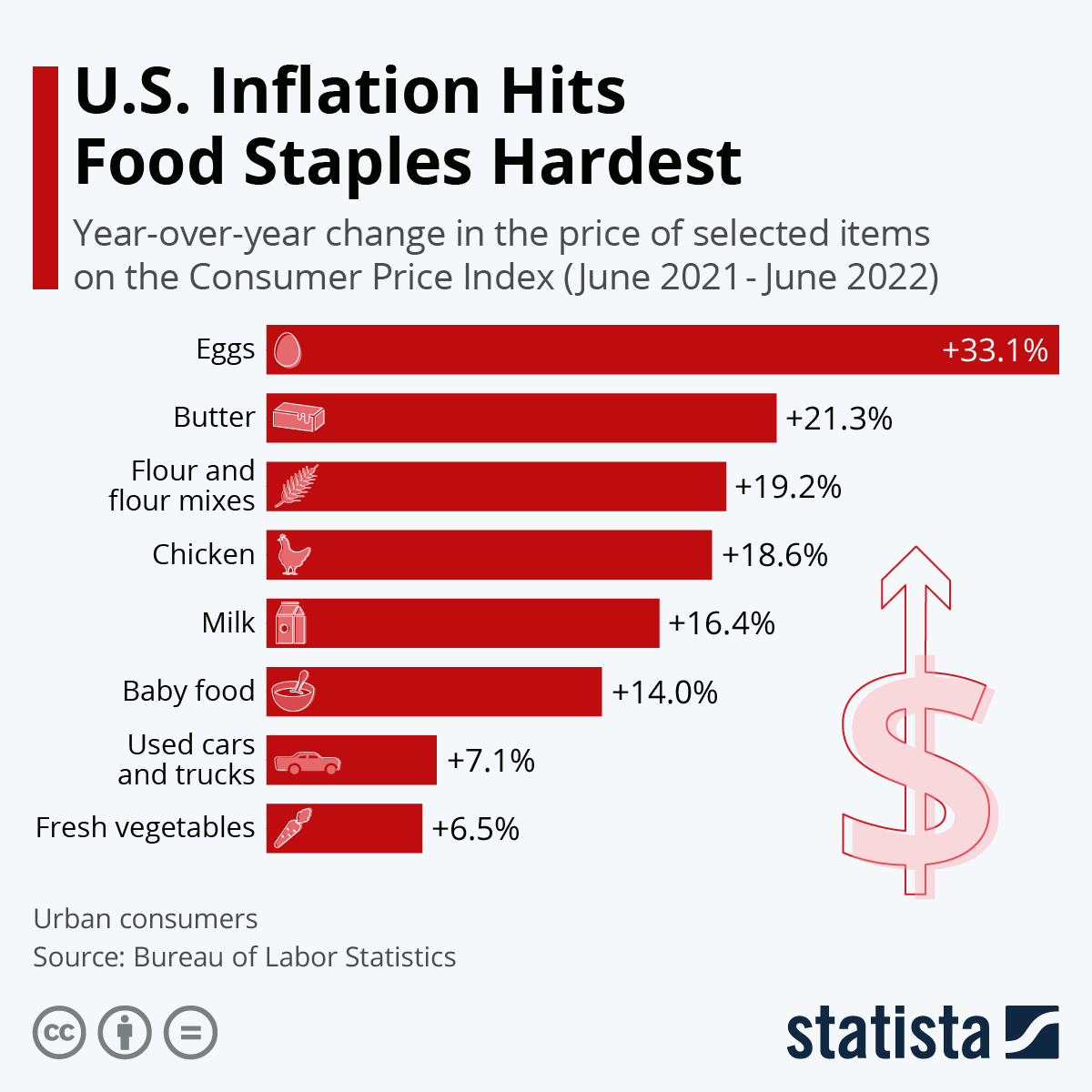

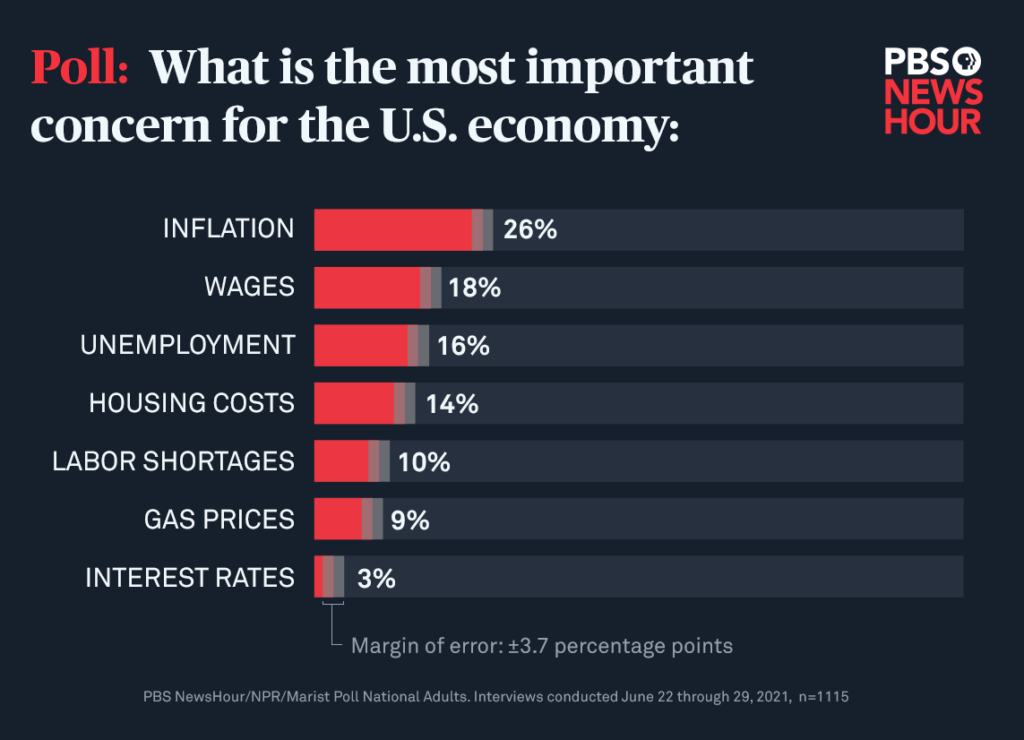

Rising interest rates will represent the third "shock" investors have had to deal with over the past three years. While a growth shock turned stocks into winners in 2020, an inflation shock this year led to a surge in commodity prices, which will make it even more difficult for the Fed to avoid making a policy change next year, according to BofA.

"Bear case is pandemic ending and so is $30 trillion of emergency policy stimulus," BofA said, referencing the liquidity provided by global central banks since the pandemic began. The bank pointed to three catalysts that give it confidence the Fed will raise interest rates next year instead of waiting until 2023 like most investors expect.

1. "Powell re-nomination triggers more hawkish Fed rhetoric." Jerome Powell's current term as Fed Chairman

ends in February.

2. "Payroll recovers," meaning the economy no longer needs near-zero interest rates as stimulus.

3. "Wage and rent inflation remains elevated," which can be combated with higher interest rates.

"We are on the cusp of a policy pivot from pro-growth to anti-inflation, [and a] policy mistake has already happened," BofA said, inferring that the Fed is behind the curve and should have already been reducing its stimulus programs.

The Fed

has signaled that it plans to end its $120 billion monthly bond buying program by the middle of next year with a monthly tapering.

But despite the bleak outlook for 2022, investors shouldn't sell their stocks just yet.

Instead, investors should wait to sell stock after an expected year-end rally due to already bearish investor positioning. "More bearish Wall St positioning reflects concerns [about] inflation and China, [which] supports a typical year-end rally.

We say sell it," BofA said.

Read more: 'History repeats itself': The manager of an inflation-focused ETF breaks down why she thinks stagflation is the 'biggest threat' to investors - despite Wall Street saying fears are overhyped

BofA expects already bearish investor positioning to help drive a rally into year-end before 3 bearish catalysts knock down stocks in 2022.

markets.businessinsider.com