- Joined

- Jan 14, 2006

- Messages

- 13,452

- Reaction score

- 23,762

But you have to give him credit that he did disrupt and accelerate transformation of the auto industry. Remember this and how it went nowhere?

View attachment 347497

The EV1 and the MOOC

Lessons for higher education from the demise of GM’s 1990s electric car.

By

Joshua Kim

October 3, 2018

What to do with the MOOC?

That is a question that many schools that began programs to build and run open online courses in those heady MOOC bubble days of 2012 are asking themselves six years later.

In answering the question about what to do with our MOOC programs, we might want to look to the story of the General Motors EV1.

Remember the EV1?

Maybe you saw the 2006 documentary film Who Killed the Electric Car? Our collective memory is that GM killed the EV1 to protect the company’s insanely profitable business of selling gas-guzzling SUVs. Remember the Hummer?

We remember how GM refused to renew the leases on the EV1, and how they sentenced the returned electric vehicles to the crusher. GM didn’t just stop selling the EV1 -- it destroyed them.

The real reason that GM killed the EV1 was not some diabolical plot to protect a business built around gas guzzlers. Instead, the reasons were far more prosaic and depressing. GM killed the EV1 because it was too expensive -- the car had a fully loaded development cost of nearly $1 million per vehicle. In the face of little demand for a two-seat car that could only go 50 miles on a charge, GM could not justify continuing the program.

Why did GM refuse to allow EV1 owners to keep their vehicles? The reason is that the company was afraid of liability. It didn’t know if the lead-acid batteries would be safe.

Why did GM crush those cars that they repossessed? Chalk that one up to the dysfunction of GM’s management circa 1999.

The fascinating question is where would have GM been if it had maintained its investment in the EV1 experiment?

A convincing analysis of the mistake that GM made in killing the EV1 appears in the new book Autonomy: The Quest to Build the Driverless Car -- and How It Will Reshape Our World, co-written by Lawrence Burns. Burns was GM's vice president of research and development for 30 years and today is an adviser to Google’s (Waymo) self-driving car initiative. He writes that:

Even from the vantage point of the late 1990s, it was clear to many that the auto industry would have to change eventually. And that the environmental, economic and security implications of relying on foreign oil to make gasoline to run our automobiles would exact an increasingly high price.

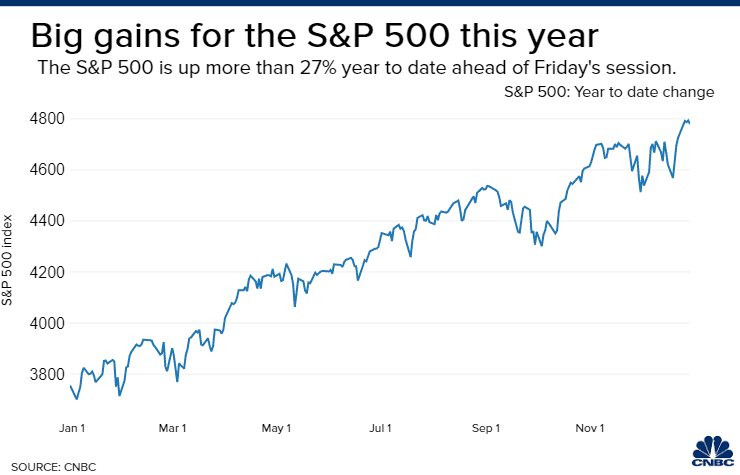

Today, Tesla is valued higher than General Motors ($52.5 billion vs. $47.5 billion). Every car company is scrambling to bring out hybrid and electric models. GM could have been way ahead of the game.

We should think of today’s MOOCs as yesterday’s EV1.

When compared to traditional online courses, today’s MOOCs are not very good. Open online courses do many wonderful things. They are a marvelous way to bring lifelong learners together around educational content. The ability of MOOCs to reinforce learning through simulations and formative assessment is improving rapidly.

Today’s MOOCs, however, have not succeeded in the goal of providing quality learning at scale. MOOCs have done very little so far to bring down the costs of postsecondary credentialing. There are some interesting experiments with low-cost online degrees from highly regarded institutions, such as the $22,000 iMBA from the University of Illinois and Georgia Tech's $10,000 online master of science in cybersecurity program. These programs, however, do not seem to be driving the overall cost of education downward.

But we are early in the open online learning game.

The online courses that we have today that can scale at low marginal costs are in their infancy. The goal of personalization at scale has not yet been reached.

We should think of today’s MOOCs as opportunities for educational experimentation. To try new things out to reach the goal of delivering a high-quality education at lower costs.

The global demand for postsecondary education will follow a similar trajectory to the worldwide demand for automobiles. Our current system of small-scale education and fossil fuel-based cars will not be sustainable.

Today’s open online courses may be as ungainly as the EV1. But imagine what might happen if we resist the temptation to crush them.

Read more by

Joshua Kim

Funny how Tesla had a market cap of $52B when that article was written in late 2018 and is now $1.1T.