D

deleted59964

So to the investment gurus out there, do you see this as a significant event, are you just going to ride this out or are you altering your investments expecting a downturn?

So to the investment gurus out there, do you see this as a significant event, are you just going to ride this out or are you altering your investments expecting a downturn?

No one can time the market.

...

not reliably - no doubt about that.

but I think COVID19 will cause significant impact.

you’d likely have to pick the right company that develops the vaccine.

Here are my clinical though in a thread titled COVID 19 econ:i’ve found it interesting how there is nothing clinical on this topic on this board.

In general, owning stock in the company where you are an employee is foolish. If you got that stock as part of your employment, it's best to dispose of it as soon as you are contractually able to. Having a large chunk of your net worth in one company, and having your income depend on that same company, is the ultimate anti-diversification. Add a dash of emotional connection (positive or negative) to the decision to keep or sell that particular equity, and it's just begging for things to end in tears.Whatever you do, remember nobody has it worse than Mednax "partners" who lost 20% of their equity just today. Most buy-ins are 250k, so just like that $50k drained away in one day...Mednax stock has to be one of the most useless equity stakes in the world.

Which patients are you going to wear an n95 mask for?Here are my clinical though in a thread titled COVID 19 econ:

Droplet isolation with N95 mask just in case.

Lung protective strategy on ventilation.

Make sure the venous cannula isn't up against a wall when you put them on VV ECMO.

I believe N-95 can filter 0.3 micron but the virus is 0.08 micron anyways.Which patients are you going to wear an n95 mask for?

can be transmitted by sub clinical patients.

I don't think they've conclusively established how the novel coronavirus is transmitted, if it's primarily large droplet borne (probably) or if it's airborne like TB, measles, smallpox, legionnaire's disease, etc. There's evidence that some flu and coronaviruses might be transmissible on droplet nuclei, which can remain suspended in air for a long time, but it appears that this is "possible within the realm of physics" as opposed to "common" ....I believe N-95 can filter 0.3 micron but the virus is 0.08 micron anyways.

Unfortunately the virus can be transmitted by patients who have not yet developed symptoms, so when are you going to put an n95 on?I don't think they've conclusively established how the novel coronavirus is transmitted, if it's primarily large droplet borne (probably) or if it's airborne like TB, measles, smallpox, legionnaire's disease, etc. There's evidence that some flu and coronaviruses might be transmissible on droplet nuclei, which can remain suspended in air for a long time, but it appears that this is "possible within the realm of physics" as opposed to "common" ....

Definitions vary but most put "droplets" at > 5 um and "droplet nuclei" at > 1 um though I've seen > 0.5 um also. An N95 mask ought to be fine if it fits properly. I'm in no hurry to test this out myself.

Anyway, point being, airborne virus transmission via free-floating individual virus bodies, not carried by dust or water droplets, doesn't seem to be a thing. So I think the 0.08 um size of one virus entity isn't an important number.

Only on the rare occasions when I get out of MOPP 4, I'm not crazy.Unfortunately the virus can be transmitted by patients who have not yet developed symptoms, so when are you going to put an n95 on?

Coronavirus outbreak to cost airlines almost $30bn

Airline industry body IATA predicts global air travel demand will fall for the first time since 2009.www.bbc.com

No, highlighting this is a significant event and it will have some fallout.What’s your point here? Trying to desperately show us how we are all so wrong?

I'm 31, a resident that is maxing out Roth IRA every year.

100% of my investments are sitting in cash.

"no one can time the market", but i'm timing the market.

The plan is to go in 100% on the lowest cost index fund when the market corrects.

There's a giant chasm of a gap between recognizing that [world event] can impact a segment of the economy, and turning that recognition into consumer-investor level stock market trades that will profit from that event.No, highlighting this is a significant event and it will have some fallout.

I am one of the least financially literate people here, but I‘m sure the old mantra of time in the market, not timing the market is the right thing to do...

yeah no one can time the market. This was me > 2 years ago:

the S&P 500 has gained about 40% since i posted that. All my roth still sitting in cash.

It's a good lesson to learn in the very early years of your investing career.

My big market timing moves as a student and resident also lost a ton of money. Of course, "a ton" of money to me then is a day's paycheck now ... it's an education I paid for, except instead of my tuition going to a university my tuition went to the endless void of E*Trade.

FWIW, i knew this would be the outcome a good portion of the time. The total amount that I would have earned/lost is about 1 week's paycheck as an attending. Looking back at the decision. I still believe it was +EV (schilling index was high, everything felt like a bubble etc).

Either way I HAD to see it. It's like as a scientist, i knew drinking baking soda probably won't make my workouts better. But I just had to try it once, it's out of my system now, but everything is still in cash lol.

Sounds like it's not out of your system if you're still all in cash. Just do it man. Throw it all into something other than cash. You're literally LOSING money due to inflation. You could throw it all into a Target date retirement fund, s&p500, VTSAX, or any other low cost total market fund. You're young with a very long investment horizon. Even if you have 50k in your Roth IRA and it loses half its value, you'll be just fine.FWIW, i knew this would be the outcome a good portion of the time. The total amount that I would have earned/lost is about 1 week's paycheck as an attending. Looking back at the decision. I still believe it was +EV (schilling index was high, everything felt like a bubble etc).

Either way I HAD to see it. It's like as a scientist, i knew drinking baking soda probably won't make my workouts better. But I just had to try it once, it's out of my system now, but everything is still in cash lol.

It's the retroscope, man. Beware.

Dow Industrials Close 1,000 Points Lower as Coronavirus Cases Mount

Investors around the world stepped up their retreat from stocks and piled into haven assets like government bonds and gold, reflecting escalating worries that the coronavirus will crimp global growth.www.wsj.com

Everything is obvious in retrospect. They look at volatility and think Gee I could have predicted that (or even Gee I did predict that). And they convince themselves that they have the insight to predict future moves because history is obvious.

yeah no one can time the market. This was me > 2 years ago:

the S&P 500 has gained about 40% since i posted that. All my roth still sitting in cash.

If it goes global we are looking at 5 million dead Americans, 117 million dead globally if it spreads to maximum predicted levels (60%), half that if control measures limit it to Spanish Flu penetration levels. The economic impact of a global pandemic could cause a global depression. If it is contained early, which is looking to be exceedingly less likely, the prediction is an end to widespread infection by the end of April, with economic impacts lasting months instead of years.not reliably - no doubt about that.

but I think COVID19 will cause significant impact.

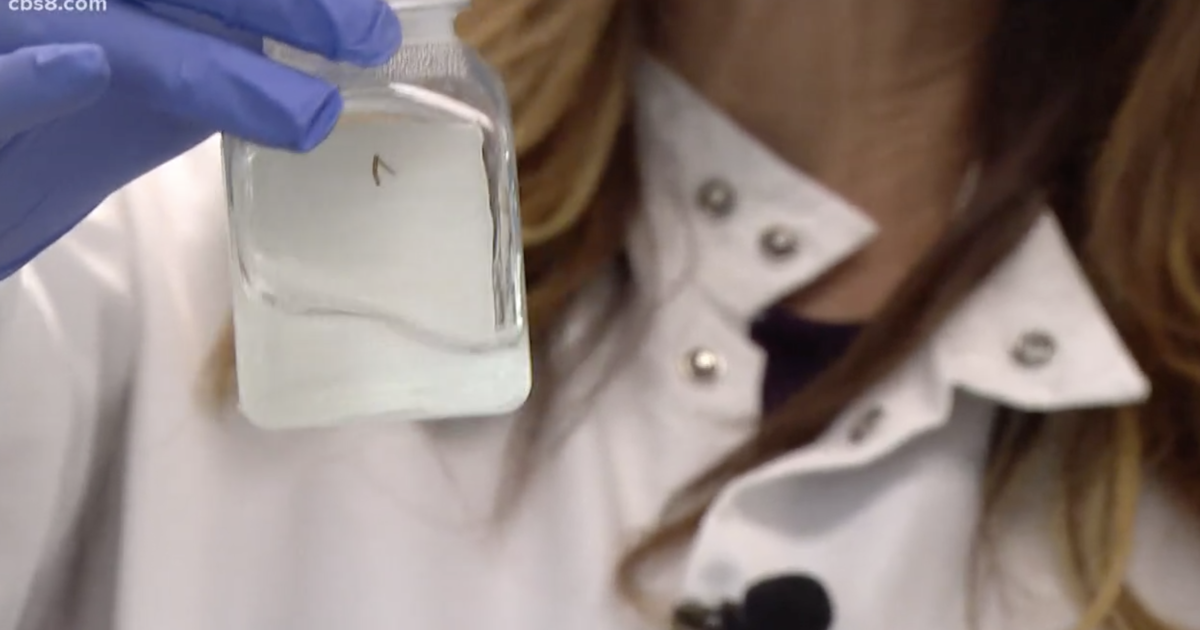

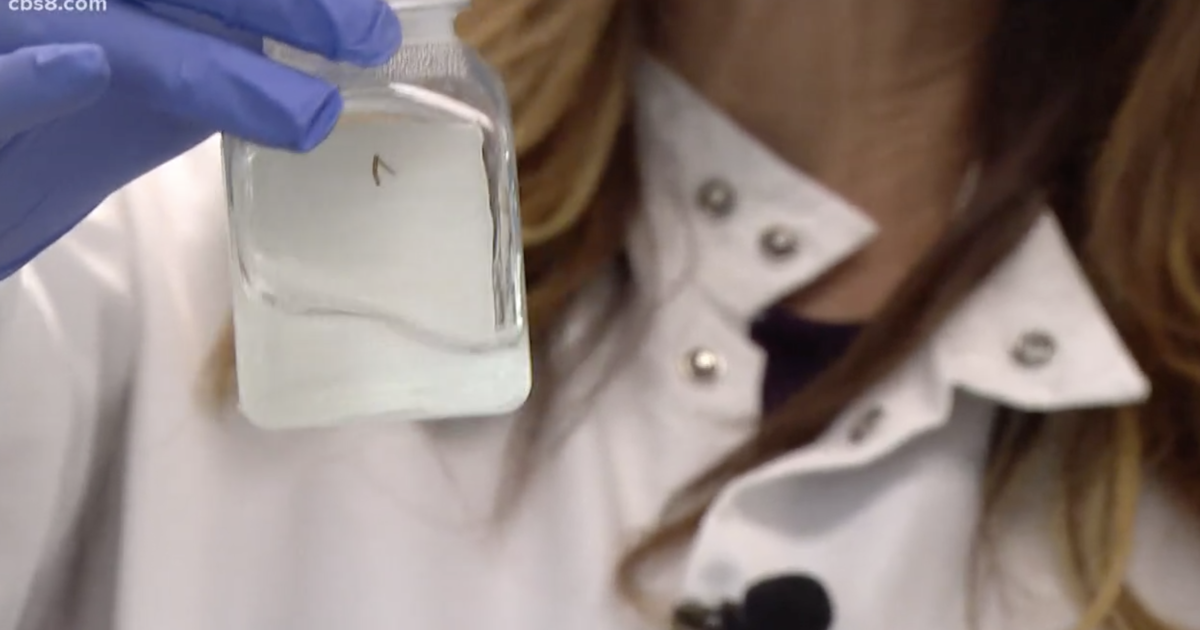

San Diego lab claims to have discovered a coronavirus vaccine in 3 hours — but testing it will take months

Drug companies and labs worldwide are scrambling to come up with a vaccine to stop the deadly new virus.www.cbsnews.com

The first vaccine in China is expected to be ready for clinical trials by the end of April, according to Xu Nanping, China’s vice-minister of science and technology.

Sounds like it's not out of your system if you're still all in cash. Just do it man. Throw it all into something other than cash. You're literally LOSING money due to inflation. You could throw it all into a Target date retirement fund, s&p500, VTSAX, or any other low cost total market fund. You're young with a very long investment horizon. Even if you have 50k in your Roth IRA and it loses half its value, you'll be just fine.

Dollar Cost Averaging Is For Wimps

Learn what dollar-cost averaging IS and ISN'T and why there are better ways to reduce risk. Manage emotions, avoid regret, and skip the hassle of DCA.www.whitecoatinvestor.com

@dchz, do NOT try to time the market. The only reason not to be 100% (not considering the emergency funds) in stocks, at your age, is to sleep well at night. Set it to a S&P 500 or total stock market index or target fund, and forget it for 30 years.

And lump sum investing beats DCA most of the time, because the market goes up 80% of the time (at least historically).

Especially as a trainee, invest all the money you can afford in stocks. This is all peanuts when compared to your attending salary, but it gets really big after 30-40 years, through the magic of compounding. Bonds have been dangerous, because one could lose money if interest rates go up (and there isn't much space for them to go down). Invest as much as it would allow you to sleep well at night, even if the market drops 50-60%.

So who’s adding Inovio to their portfolio?

Why would I invest in an evil pharmaceutical company? Especially one in California run by immigrants? They’re just trying to give us autism.

This too shall pass.So to the investment gurus out there, do you see this as a significant event, are you just going to ride this out or are you altering your investments expecting a downturn?

of course it will, my point was this will be a significant event.This too shall pass.