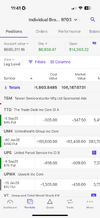

New portfolio. After yesterday's big positive day, vix closing below 20, yesterday I went back to 129 days to expiration (september) on almost all positions. Today I took a massive thrashing because of UHC (I had 12 contracts at $270 strike to start the day). I dropped my strike and kept increasing position size ultimately ended with 35 contracts $230 strike. Short term pain for long term gain.

I figured out and learned something new - I was not fully utilizing my account properly, now I am.

Not only do i have options contracts open worth a couple million that have given me 60k premium for some 4 months. I also have 680k sitting in SGOV returning 4.5% risk free (30k annual at current yield - but expected to drop as fed drops rates).

This portfolio satisfies both margin maintenance requirements (positive 18k currently), while having a positive cash balance (96K) meaning im not charged any interest on margin. And it also gives me the luxury of liquidating SGOV at any time to free up 1/3 x 680k (~200K) of buying power to avoid any capital calls or to protect myself in any bad situation.

It's actually something really cool and I'm going to explain it here.

I have 810k cash in the account (account value + Options premium).

I've purchased $680k + 30k of VT - So 100k positive cash in account (no margin being used. No interest to pay) - Risk free Dividend yield from SGOV.

SGOV + VT - Each $1 spend there only uses 30% buying power for margin maintenance excess to avoid margin call for naked puts. So 680 + 30k = 710k = 30% buying power used is 215k

Current options contracts require $582k of cash sitting on the side. So 582 + 215 = 797; Leaves about 18k maintenance excess.

So not only can I get returns from premiums, but I should keep getting massive risk free and state income tax free dividends from SGOV. This risk free return I was leaving on the table previously. And because SGOV only uses 30% for maintenance, It still leaves plenty of available capital to play options with.