I think you need to post some graphs with maybe some lines crossing and some arrows, maybe, um, red ones and green ones.

For starters, I'd need more than 12 months of ~5% inflation to call it "runaway"

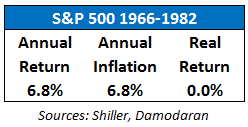

... the 1970s had annual inflation in the 5-15% range for essentially the whole decade.

The simple obvious answer right now is that current inflation is a result of surging demand in the face of pandemic-related supply disruptions, and not simply monetary policy or your M figures. I'm not saying we should just blow off government stimulus or printing as irrelevant, but at this point there's N O T H I N G to indicate that A N Y of the current price hikes relevant to anyone's life are a result of

too much money helicoptering down into the hands of eager consumer spenders.

But regardless, no, I'm not going to "react" to a few months of 5% inflation by changing my personal investment strategy: mostly US and international equities, with some bonds, real estate, and a very small % of cash and physical PMs.

Edit - Actually, my primary investment this month is renovating the house we bought in December, which is turning out to be way more expensive than I'd initially planned, mainly because skilled labor is so unbelievably busy/scarce and some materials are on a 12+ week backorder because DEMAND is so high and SUPPLY is so low. But I guess it'd be more sexy to say the bill for my new kitchen cabinets is high because of M2 ...